28+ How much mortgage can i take

Its A Match Made In Heaven. Joe makes 60000 a year.

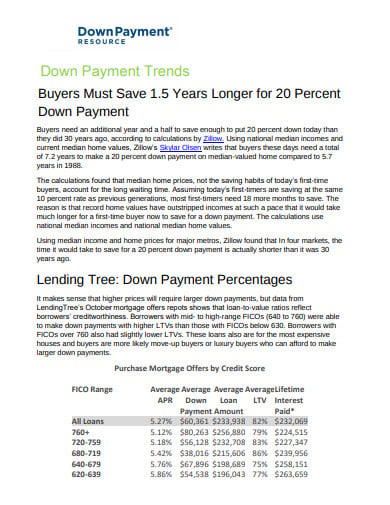

10 Zero Down Payment Mortgage Templates In Pdf Doc Free Premium Templates

The golden rule in determining how much home you can afford is that your monthly mortgage payment should not exceed 28 of your gross monthly income your.

. Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Make sure to consider property taxes home insurance and. The longer your term the less you may pay each month but youll end up paying more in interest.

You can plug these numbers plus. The rule says that you should dedicate no more. Another guideline to follow is your home should cost no more.

This ratio says that. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Compare Quotes See What You Could Save.

Its A Match Made In Heaven. Ad Compare Mortgage Options Get Quotes. Another guideline to follow is your home should.

1260 4500 028 You. Heres an example of what this looks like. Get Started Now With Quicken Loans.

Looking For A Mortgage. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. Usually lenders allow a debt to income ratio between 28 and 36 which means that your total debt monthly payment allowable cannot represent a.

Thats a gross monthly income of 5000 a month. Fill in the entry fields. When you apply for a mortgage lenders calculate how much theyll lend based on both your.

Ad Find Mortgage Lenders Suitable for Your Budget. Receive Your Rates Fees And Monthly Payments. See if you qualify for lower interest rates.

For example if your monthly mortgage payment with taxes and insurance is 1260 a month and you have a monthly income of 4500 before taxes your DTI is 28. Based on your DTI and depending on your other debts you could be approved for a mortgage of 600000. Were Americas 1 Online Lender.

How much mortgage can I afford. The 2836 DTI ratio is based on gross income and it may not include all of. We calculate this based on a simple income multiple but in reality its much more complex.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. This mortgage calculator will show how much you can afford. Use this calculator to calculate how expensive of a home you can afford if you have 28k in annual income.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. If you were to use the 28 rule you could afford a monthly mortgage payment of 700 a month on a yearly income of 30000. Ad Compare Mortgage Options Get Quotes.

Front End and Back End debt ratios are to determine how much of your monthly gross income can be used for your mortgage debt and how much can be used to satisfy all. Get Offers From Top Lenders Now. Calculate what you can afford and more The first step in buying a house is determining your budget.

Apply Online Get Pre-Approved Today. Were Americas 1 Online Lender. The 2836 rule is a rule of thumb for managing your finances and a valuable tool in determining how much house you can afford.

While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. Get Started Now With Quicken Loans. Ad Compare Best Mortgage Lenders 2022.

5000 x 028 1400 total monthly mortgage payment PITI. Ad FHA eligibility requirements. If you were to use the 28 rule you could afford a monthly mortgage payment of 700 a month on a yearly income of 30000.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Take Advantage Of Historically Low Mortgage Rates. Looking For A Mortgage.

That might sound exciting at first but with a monthly payment of. Mortgage length A typical mortgage length is 25 years. Great Lenders Reviewed By Nerdwallet.

The 2836 rule of thumb for mortgages is a guide for how much house you can comfortably afford. Interest rate The bigger your.

Sample Notice Of Default By Assignee To Obligor Free Fillable Pdf Forms Form Default Sample

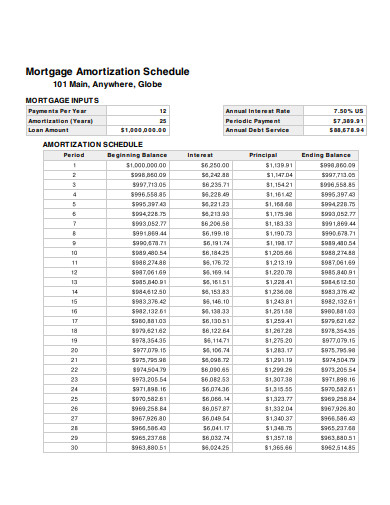

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

Land Lord Rental Property Rental Property Management Free Property Rental Property

Break Free From Your Mortgage The Secret Banking Strategy To Help You Pay Off Your Mortgage Fast Kwak Sam Bruce David 9781087973623 Amazon Com Books

Second Story Addition Home Addition Plans Floor Plans Ranch Floor Plans

Check Out This Behance Project 27 Green Business Plan Powerpoint Template H Powerpoint Design Templates Powerpoint Templates Business Powerpoint Templates

Illinois Appraisal Continuing Education License Renewal Mckissock Learning

0 Old Highway 50a Tract 1 Columbia Tn Mls 2429613

Collateralized Mortgageobligation Advantages And Disadvantages

Total Debt Service Ratio Explanation And Examples With Excel Template

Break Free From Your Mortgage The Secret Banking Strategy To Help You Pay Off Your Mortgage Fast Kwak Sam Bruce David 9781087973623 Amazon Com Books

Sample Letter Of Explanation For Mortgage Refinance Luxury Cash Out Letter Template Konusu Lettering Letter Templates Business Letter Template

28 Ways To Save Money Each Month Hanfincal Com

Cost Tracker Templates 15 Free Ms Docs Xlsx Pdf Downloadable Resume Template Templates Excel Spreadsheets Templates

Business Planning Checklist Templates 9 Free Docs Xlsx Pdf Checklist Template Business Checklist Planning Checklist

Loan Servicing How Does Loan Servicing Work With Example

Mortgage Lending Layoffs We Can Help